Yesterday, SEC Chairman Mary L. Schapiro, testified before the Senate Subcommittee on Financial Services and General Government and outlined the changes the SEC is making to "reinforce our focus on investor protection and market integrity and redirect our energies toward restoring investor confidence."

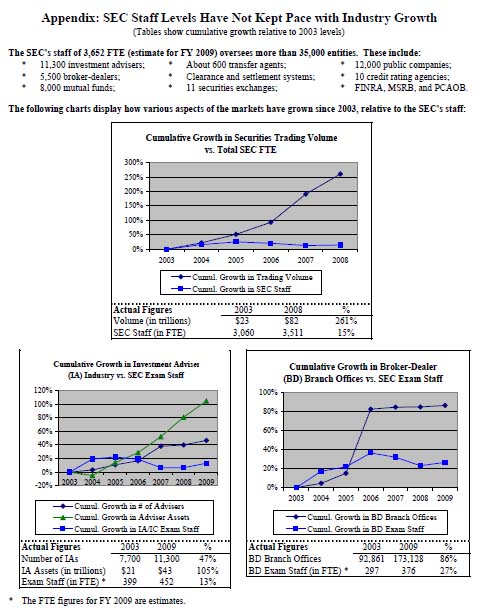

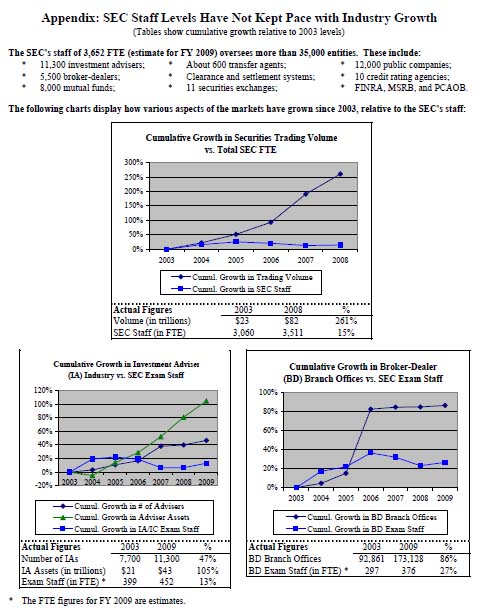

Schapiro stressed that the securities markets have grown dramatically and become extraordinarily complex in recent years. The volume of daily trading of stocks, options and futures has increased by orders of magnitude, as have the number of market participants, including broker-dealers and investment advisers. "Yet at the same time that the securities markets have undergone such tremendous growth, the SEC's resources have fallen further and further behind." Schapiro provided the following data illustrating her point about SEC staffing levels:

Chairman Schapiro urged additional resources for the SEC to help it keep up with the growth and increasing complexity of the securities markets.

Ms. Schapiro also promised reinvigorated enforcement and examination, and improved risk-based oversight of broker-dealers, investment adviser, and mutual funds. Reacting to recent compliance issues within the Commission, Schapiro vowed "to build an internal compliance program that is second to none," to guard against inappropriate securities trading by SEC staff, as well as to avoid any appearance of inappropriate trading.

Of particular interest to the investment management industry, Chairman Schapiro also promised action on money market fund reforms, target-date funds, and rule 12b-1.

The full text of Chairman Schapiro's June 2, 2009 testimony is available at: http://sec.gov/news/testimony/2009/ts060209mls.htm

The appendix referred to by Chairman Schapiro illustrating staffing levels is available at: http://sec.gov/news/testimony/2009/ts060209mls-app.pdf

Related articles:

Schapiro stressed that the securities markets have grown dramatically and become extraordinarily complex in recent years. The volume of daily trading of stocks, options and futures has increased by orders of magnitude, as have the number of market participants, including broker-dealers and investment advisers. "Yet at the same time that the securities markets have undergone such tremendous growth, the SEC's resources have fallen further and further behind." Schapiro provided the following data illustrating her point about SEC staffing levels:

Chairman Schapiro urged additional resources for the SEC to help it keep up with the growth and increasing complexity of the securities markets.

I believe additional resources are essential if we hope to restore the SEC as a vigorous and effective regulator of our financial markets. The President is requesting a total of $1.026 billion for the agency in FY 2010, a 7 percent increase over the FY 2009 funding level. This proposal would permit the SEC to fully fund an additional 50 staff positions over 2008 levels, enhance our ability to uncover and prosecute fraud, and begin to build desperately needed technology.According to Schapiro, additional resources would help the Commission hire more attorneys with the skills necessary to increase enforcement efficiency, deal with tips and leads aggressively and carefully, and hire market experts to help the Commission keep up with innovations and changes in the markets as well as implementing "risk-based oversight of the investment management industry and expand its inspections of credit rating agencies."

Ms. Schapiro also promised reinvigorated enforcement and examination, and improved risk-based oversight of broker-dealers, investment adviser, and mutual funds. Reacting to recent compliance issues within the Commission, Schapiro vowed "to build an internal compliance program that is second to none," to guard against inappropriate securities trading by SEC staff, as well as to avoid any appearance of inappropriate trading.

Of particular interest to the investment management industry, Chairman Schapiro also promised action on money market fund reforms, target-date funds, and rule 12b-1.

Money Market Funds

Later this month, the SEC will consider proposals to strengthen the money market fund regulatory regime. The proposals will focus on tightening the credit quality, maturity and liquidity standards for money market funds to better protect investors and make money market funds more resilient to risks in the short-term securities markets, like those that unfolded last fall. In addition, we are exploring whether more fundamental changes are necessary, such as converting money market funds to a floating rate net asset value, in order to protect investors from abuses and runs on the funds.

Target Date Funds

[T]arget date funds have produced some troubling investment results. The average loss in 2008 among 31 funds with a 2010 retirement date was almost 25 percent. In addition, varying strategies among these funds produced widely varying results. Returns of 2010 target date funds ranged from minus 3.6 percent to minus 41 percent.

These returns cause concern for investors and regulators alike. I can assure you that SEC staff is closely reviewing target date funds' disclosure about their asset allocations. In addition, in connection with our joint hearing with the Department of Labor, we will consider whether additional measures are needed to better align target date funds' asset allocations with investor expectations. Among other issues, we will consider whether the use of a particular target date in a fund's name may be misleading or confusing to investors and whether there are additional controls the SEC should impose to govern the use of a target date in a fund's name.

Rule 12b-1

I also have asked the staff to prepare a recommendation on rule 12b-1, which permits mutual funds to use fund assets to compensate broker-dealers and other intermediaries for distribution and servicing expenses. These fees, with their bureaucratic sounding name and sometimes unclear purpose, are not well understood by investors. Yet in 2008, rule 12b-1 was used to collect over $13 billion in investors' funds out of fund assets. It is essential, therefore, that the SEC engage in a comprehensive re-examination of rule 12b-1 and the fees collected pursuant to the rule. If issues relating to these fees undermine investor interests, then we at the SEC have an obligation to step in and adjust our regulations.

The full text of Chairman Schapiro's June 2, 2009 testimony is available at: http://sec.gov/news/testimony/2009/ts060209mls.htm

The appendix referred to by Chairman Schapiro illustrating staffing levels is available at: http://sec.gov/news/testimony/2009/ts060209mls-app.pdf

Related articles:

- "Forum Comments on Potential Money Market Reforms," June 1, 2009

- "SEC and DOL Seek Input on Target Date Funds," May 27, 2009

- "Chairman Schapiro's First Address to the Fund Industry," May 4, 2009

- "Donohue Outlines IM Regulatory Priorities," March 24, 2009